International benefits: disability and death protection

The WorldHealth Protect® international provident program is designed to cover you and your loved ones in the event of loss of income due to illness, accident or death. And for even greater peace of mind, your provident policy can be enhanced with a “critical illness” option, providing a lump-sum payment as soon as a major illness is declared.

FINANCIAL SUPPORT FOR :

- Illness and accident

- Assistance / Repatriation service

- International Routine Care

- International assistance

Discover the DNA of WorldHealth Protect® international life insurance.

Available in :

Punctual coverage (<1 year)

Annual coverage (> 1 year)

Would you like to protect your income and ensure your financial security in the event of accident or illness? Our international contingency plans are tailored to your situation, enabling you to maintain your standard of living, compensate for financial losses and support your family.

Temporary or permanent disability

Our contingency insurance provides you with financial support in the event of a one-off or lasting drop or loss of income:

- Permanent or permanent disability: payment

of a lump sum - Income protection in the event of temporary inability to work

- International, multi-currency coverage (EURO, CHF, USD or GBP)

- Extended coverage, possible for international

at international level

Death benefit and “Critical Illness” option

We pay a lump-sum death benefit to your loved ones in the event of your death:

- Choice of lump sum

Additional protection in the event of an accident - Coverage available even if you have pre-existing health problems

- Extension of death cover to critical illness (optional)

- Capital payment if you are diagnosed with a serious medical condition

OUR SUPPORT

A reactive compensation procedure in the event of an emergency

We know that when you’re going through a difficult event, you need immediate answers. That’s why WorldHealth Protect® does its utmost to process your case as quickly as possible. We provide you with responsive teams and straightforward procedures, so you can benefit from financial support quickly and deal with every situation with complete peace of mind.

We’re with you every step of the way

You lose your income

temporarily or permanently

- ➜ Fill out an online application form from your personal account

- ➜ Please send us all the supporting information we need to assess your situation and provide you with assistance.

- ➜ Depending on your situation, we pay you a lump-sum premium or a monthly indemnity (annuity).

In the event of death, your next of kin receive a capital

- ➜ The beneficiary(ies) designated when you subscribed to an international provident contract send us the documents required for the claim declaration

- ➜ The lump sum is paid within a very short timeframe, enabling them to cope and move forward with greater peace of mind. If you take out the Critical Illness option, we initiate payment of the capital sum as soon as the illness is declared.

WWW.MYGOLDENCARE.COM

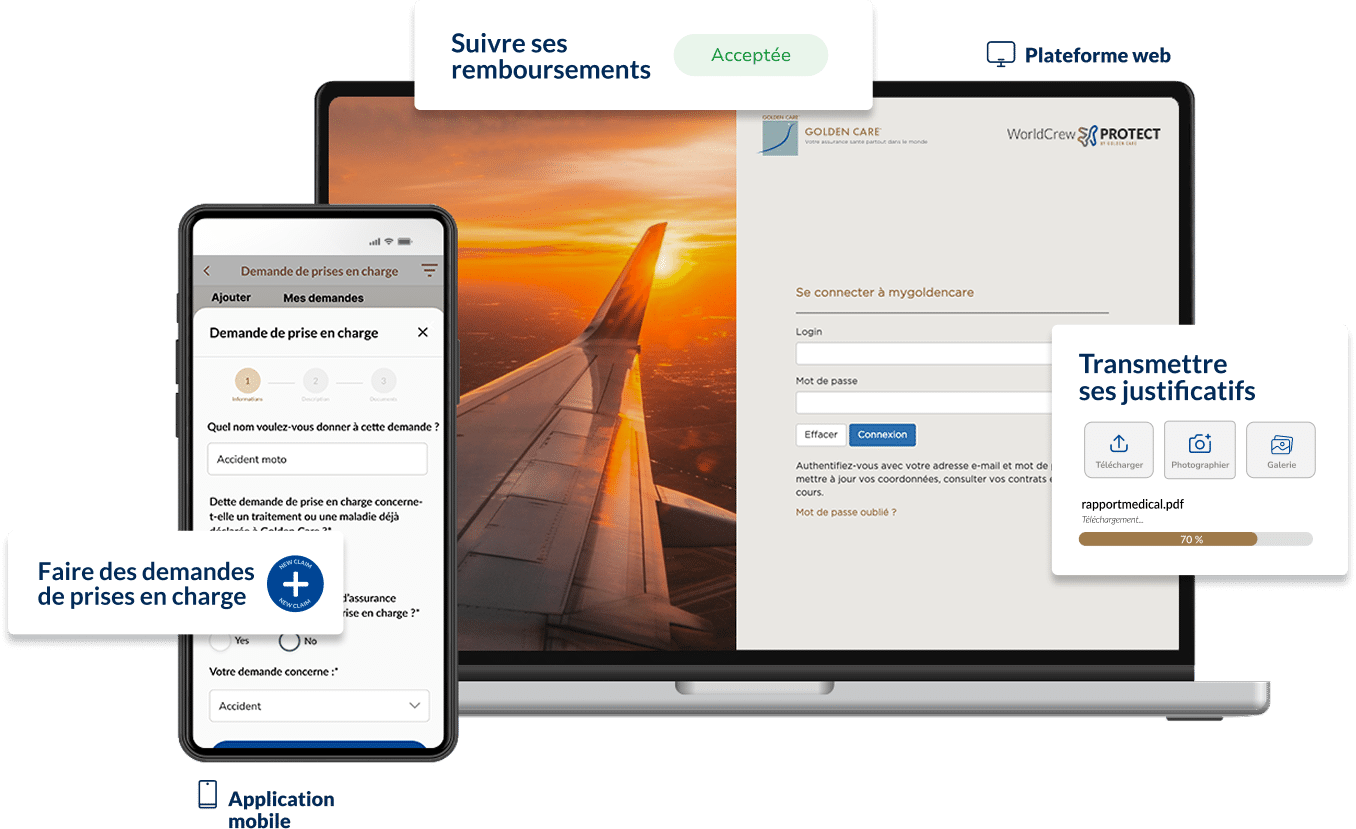

Insurance management in just a few clicks

Easily manage your international provident policy at www.mygoldencare.com. We’ve designed a platform and mobile application dedicated to your insurance offers, so you can modulate your cover and bring it to life, from any country in the world.

AN ONLINE PERSONAL SPACE & A MOBILE APPLICATION FOR :

- Update your insurance profile

- Adjust and modify your insurance benefits to suit your needs

- Simplified transmission of your medical history via a secure online questionnaire

- Intuitive claims system

- Monitoring repayments and capital payments

- Responsive support and customer service to meet your needs

ARE YOU A COMPANY?

Find out more about our international contingency plans, designed as part of a group contract, to protect your employees at every level:

- ➜ Mutuelle internationale

- ➜ Prévoyance internationale

- ➜ Collection insurance

LEARN MORE

Complete your protection with the WorldHealth Protect® range

Whether you’re a one-off or frequent traveller, or an expatriate, WorldHealth Protect® cover can accompany you around the globe. Tailor-made offers, adapted to your needs and the risks inherent in discovering the world, whatever your country of residence or destination.

FREQUENTLY ASKED QUESTIONS

Questions you may have

about international pensions

What risks are covered by a contingency plan?

A pension plan is the ideal benefit for anyone with a professional career who lives, works or travels abroad on a regular basis:

- Expatriates: who leave their country of origin to live and work in another part of the world, may wish to protect their salary in the event of an emergency (illness, accident, sick leave, etc.).

- Seconded workers: they carry out temporary or long-term assignments elsewhere than in their country of origin, and must cover risks not covered by local social security or their usual mutual insurance company.

- Digital nomads: they work remotely while traveling the world. They need to anticipate any loss of remuneration that might occur as a result of a health event.

What is the “Critical Illness” option?

Are you browsing the comparisons to make up your mind and choose the ideal health insurance for you? Here are 4 criteria that will make you want to trust WorldHealth Protect :

- Comprehensive protection: medical coverage, international assistance, personal protection, kidnap insurance… Our contracts cover all the essential aspects of your protection.

- A tailor-made approach: create the contract that’s right for you by choosing the coverages that interest you.

- Borderless support: our contracts are tailored to your needs, wherever you’re going.

- Fair, transparent pricing: our rates are calculated according to your choices and profile at the time of purchase. Our rates are indexed to medical inflation and to the age of our policyholders.

What are the best options for expatriate health insurance?

Are you browsing the comparisons to make up your mind and choose the ideal health insurance for you? Here are 4 criteria that will make you want to trust WorldHealth Protect :

- Comprehensive protection: medical coverage, international assistance, personal protection, kidnap insurance… Our contracts cover all the essential aspects of your protection.

- A tailor-made approach: create the contract that’s right for you by choosing the coverages that interest you.

- Borderless support: our contracts are tailored to your needs, wherever you’re going.

- Fair, transparent pricing: our rates are calculated according to your choices and profile at the time of purchase. Our rates are indexed to medical inflation and to the age of our policyholders.

As an expatriate, am I entitled to compensation anywhere in the world?

Are you browsing the comparisons to make up your mind and choose the ideal health insurance for you? Here are 4 criteria that will make you want to trust WorldHealth Protect :

- Comprehensive protection: medical coverage, international assistance, personal protection, kidnap insurance… Our contracts cover all the essential aspects of your protection.

- A tailor-made approach: create the contract that’s right for you by choosing the coverages that interest you.

- Borderless support: our contracts are tailored to your needs, wherever you’re going.

- Fair, transparent pricing: our rates are calculated according to your choices and profile at the time of purchase. Our rates are indexed to medical inflation and to the age of our policyholders.

What is the age limit for taking out Death Cover?

Are you browsing the comparisons to make up your mind and choose the ideal health insurance for you? Here are 4 criteria that will make you want to trust WorldHealth Protect :

- Comprehensive protection: medical coverage, international assistance, personal protection, kidnap insurance… Our contracts cover all the essential aspects of your protection.

- A tailor-made approach: create the contract that’s right for you by choosing the coverages that interest you.

- Borderless support: our contracts are tailored to your needs, wherever you’re going.

- Fair, transparent pricing: our rates are calculated according to your choices and profile at the time of purchase. Our rates are indexed to medical inflation and to the age of our policyholders.

BLOG WORLDHEALTH PROTECT

News & Advice on the world of insurance

More than just insurance, WorldHealth Protect® is your support and advisor throughout your adventures. Find out about the latest news from our company and our advice on international health insurance.

-

Nam nobis omnis ut labore unde earum

DiscoverTempora nesciunt delectus saepe modi vitae consectetur maxime. esse adipisci occaecati Voluptas animi ratione fugit…

: Nam nobis omnis ut labore unde earum

-

Harum vero temporibus et consequatur

DiscoverIn alias possimus rerum tempore est ut accusamus. Ut laudantium qui nobis illo a. Qui…

: Harum vero temporibus et consequatur