Retired expatriate insurance: to live  with peace of mind abroad

with peace of mind abroad

After a busy working life, you have the freedom to enjoy your retirement to the full. Whether you choose to live in the sun, travel the world or settle permanently in another country, your new life deserves to be lived without worry. Expatriation has consequences for your social protection, which you need to anticipate in order to manage all the life events you may face, with expatriate pensioner insurance tailored to your needs.

Our protection

- Sickness and accident pension insurance

- International medical assistance

- Death insurance

- Removal insurance for expatriate retirees

At WorldHealth Protect®, we’ve designed expatriate retiree insurance to help you enjoy your retirement abroad, and manage your situation more serenely in the event of accident or illness, with the sometimes complex formalities associated with your new country of residence.

FOR WHOM?

Who is our expatriate retiree insurance designed for?

Our retiree expatriate insurance policies are designed specifically for retirees living, or planning to live, abroad, whether they have already left or are in the midst of preparing their departure.

These different experiences all have one thing in common: the need to maintain reliable social protection and international health insurance adapted to their new situation.

Jean and Marie

Retired public school teachers in France, who chose Portugal for its relaxed lifestyle and tax advantages.

Spencer

Former employee seconded to Asia, who decided to stay in Thailand after his career.

Coverage available under our WorldHealth Protect® contracts

Available in :

One-off coverage (<1 year)

Annual coverage (> 1 year)

Every expatriate retiree is unique. That’s why WorldHealth Protect® offers personalized policies that can be tailored to your needs, your country of residence, your age and your career path.

International health and accident insurance

International health insurance specially designed for retired expatriates, covering :

- Medical and specialist consultations

- Hospitalization

- Prescription drugs

- Emergency care

You benefit from clear reimbursements, personalized follow-up, and the freedom to consult in your country of residence or in another country if you travel.

Good to know: For people covered by the French pension scheme, this protection complements or replaces the CFE (Caisse des Français de l’Étranger), depending on your choice.

International medical assistance

In the event of an emergency or unforeseen hospitalization, we provide a 24-hour medical assistance service:

- Medical repatriation as required

- Immediate care at local facilities

- Coordination with local and French health authorities

- Access to healthcare professionals who speak your native language

Because distance should never be an obstacle to rapid care.

Death insurance

Because peace of mind also requires foresight, our death insurance covers :

- Payment of a lump sum to designated beneficiaries,

- The Severe Illness option, which pays a lump sum as soon as a severe illness* is diagnosed.

- Coverage available in the event of pre-existing health problems (subject to conditions)

A way of protecting your loved ones, even on the other side of the world.

*Payment of lump sum if you are diagnosed with or undergo one of the following medical events: Cancer / Coronary artery bypass graft / Heart attack / Kidney failure / Major organ transplant / Stroke / Loss of limb / Blindness

Collection insurance

In some parts of the world, personal safety can be compromised. We offer specific insurance coverage for protection in the event of kidnapping:

- Coverage of crisis management costs

- Legal and psychological assistance

- Coverage of ransom costs

- Coordination with local authorities

Get a free, made-to-measure estimate online now!

International coverage,

whatever your destination

You’re a retiree on the move

If you regularly move from one country to another, alternate between several places of residence or wish to travel freely throughout the year, our insurance policies can be adapted to suit your lifestyle. Our contracts are valid for defined geographical zones, with multilingual assistance and agreements with numerous international healthcare networks.

Moving abroad when you retire

Settling permanently in a country other than your country of origin? We take into account your country of residence, bilateral social security agreements (with or without convention) and your personal and family situation, to offer you comprehensive, fair and clear coverage.

PERSONALIZE YOUR COVER

Choose the duration of your contract!

Our expatriate pension insurance offers are available in :

- ➜S hort-term period (less than 1 year) to protect you during occasional trips during your retirement,

- ➜ Long-term contract (over 1 year) for annual protection.

Our aim: to simplify your life,

and stay by your side.

WWW.MYGOLDENCARE.COM

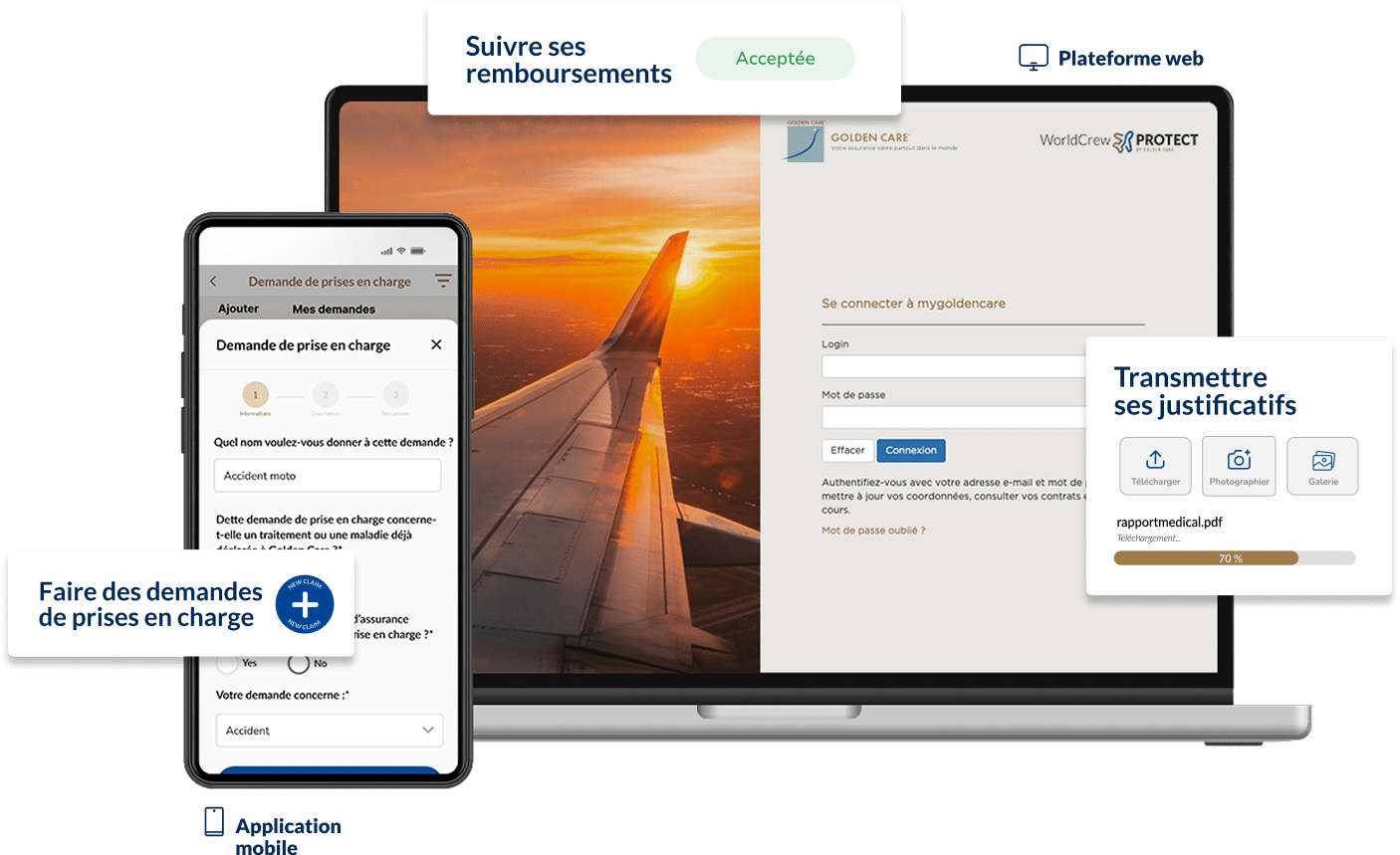

Manage your claims easily from abroad

We know what a headache administrative procedures can be when you’re far from home, especially when you’re faced with an unforeseen event. That’s why WorldHealth Protect® has developed :

A secure

personal space

An intuitive

application

Two ways to manage your contracts quickly and easily. You can :

- Underwrite and manage your insurance contracts (calculated premiums, deductibles, duration of insurance, etc.)

- Claim and justify your claims directly from abroad

- Transmit your medical documents (prescriptions, invoices, certificates, forms)

- Track the status of your reimbursements

- Download your account statements and documents (insurance statements, etc.)

- Contact an advisor in just a few clicks

FREQUENTLY ASKED QUESTIONS

The questions you

questions

What risks are covered by a contingency plan?

A pension plan is the ideal benefit for anyone with a professional career who lives, works or travels abroad on a regular basis:

- Expatriates: who leave their country of origin to live and work in another part of the world, may wish to protect their salary in the event of an emergency (illness, accident, sick leave, etc.).

- Seconded workers: they carry out temporary or long-term assignments elsewhere than in their country of origin, and must cover risks not covered by local social security or their usual mutual insurance company.

- Digital nomads: they work remotely while traveling the world. They need to anticipate any loss of remuneration that might occur as a result of a health event.

What is the “Critical Illness” option?

Are you browsing the comparisons to make up your mind and choose the ideal health insurance for you? Here are 4 criteria that will make you want to trust WorldHealth Protect :

- Comprehensive protection: medical coverage, international assistance, personal protection, kidnap insurance… Our contracts cover all the essential aspects of your protection.

- A tailor-made approach: create the contract that’s right for you by choosing the coverages that interest you.

- Borderless support: our contracts are tailored to your needs, wherever you’re going.

- Fair, transparent pricing: our rates are calculated according to your choices and profile at the time of purchase. Our rates are indexed to medical inflation and to the age of our policyholders.

What are the best options for expatriate health insurance?

Are you browsing the comparisons to make up your mind and choose the ideal health insurance for you? Here are 4 criteria that will make you want to trust WorldHealth Protect :

- Comprehensive protection: medical coverage, international assistance, personal protection, kidnap insurance… Our contracts cover all the essential aspects of your protection.

- A tailor-made approach: create the contract that’s right for you by choosing the coverages that interest you.

- Borderless support: our contracts are tailored to your needs, wherever you’re going.

- Fair, transparent pricing: our rates are calculated according to your choices and profile at the time of purchase. Our rates are indexed to medical inflation and to the age of our policyholders.

As an expatriate, am I entitled to compensation anywhere in the world?

Are you browsing the comparisons to make up your mind and choose the ideal health insurance for you? Here are 4 criteria that will make you want to trust WorldHealth Protect :

- Comprehensive protection: medical coverage, international assistance, personal protection, kidnap insurance… Our contracts cover all the essential aspects of your protection.

- A tailor-made approach: create the contract that’s right for you by choosing the coverages that interest you.

- Borderless support: our contracts are tailored to your needs, wherever you’re going.

- Fair, transparent pricing: our rates are calculated according to your choices and profile at the time of purchase. Our rates are indexed to medical inflation and to the age of our policyholders.

What is the age limit for taking out Death Cover?

Are you browsing the comparisons to make up your mind and choose the ideal health insurance for you? Here are 4 criteria that will make you want to trust WorldHealth Protect :

- Comprehensive protection: medical coverage, international assistance, personal protection, kidnap insurance… Our contracts cover all the essential aspects of your protection.

- A tailor-made approach: create the contract that’s right for you by choosing the coverages that interest you.

- Borderless support: our contracts are tailored to your needs, wherever you’re going.

- Fair, transparent pricing: our rates are calculated according to your choices and profile at the time of purchase. Our rates are indexed to medical inflation and to the age of our policyholders.

BLOG WORLDHEALTH PROTECT

News & Advice on the world of insurance

More than just insurance, WorldHealth Protect® is your support and advisor throughout your adventures. Find out about the latest news from our company and our advice on international health insurance.

-

Nam nobis omnis ut labore unde earum

DiscoverTempora nesciunt delectus saepe modi vitae consectetur maxime. esse adipisci occaecati Voluptas animi ratione fugit…

: Nam nobis omnis ut labore unde earum

-

Harum vero temporibus et consequatur

DiscoverIn alias possimus rerum tempore est ut accusamus. Ut laudantium qui nobis illo a. Qui…

: Harum vero temporibus et consequatur